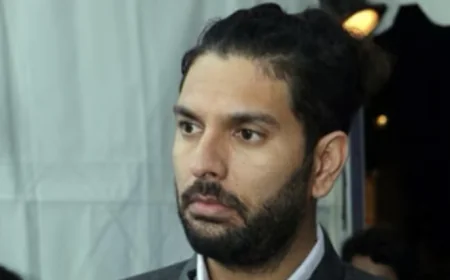

Bank of India Declares Reliance Communications Loan Fraudulent, Names Anil Ambani

Anil Ambani: After State Bank of India (SBI), now Bank of India (BOI) has marked Reliance Com's loan account as fraud over alleged fund diversion. RCom's former director, Anil Ambani's name is also included in the case. This has come to light in the filing.

After the State Bank of India, the Bank of India has declared the loan account of failed Reliance Communications as fraudulent. The name of former director industrialist Anil Ambani is also on the list. As per regulatory filings, Bank of India has also marked this loan account as fraudulent due to alleged misuse of funds during 2016.

State-owned Bank of India had extended a loan of Rs 700 crore to Reliance Communications during August 2016 for funding its current capital and operational expenses and outstanding liabilities. As per the letter of the bank in the stock exchanges' filing by RCom, part of the amount sanctioned and released in October 2016 was invested in a fixed deposit, which was not authorized according to the letter of sanction.

RCom said it received a letter from Bank of India on August 22, dated August 8, informing it of the bank's decision to classify the loan accounts of the company, Anil Ambani (promoter and former director of the company), and Manjari Ashok Kakar (former director of the company) as fraudulent.

Earlier, State Bank of India (SBI) had done the same in June this year, alleging misappropriation of bank funds by violating loan terms.

Want to get your story featured as above? click here!

Want to get your story featured as above? click here!

Following a complaint from SBI, the Central Bureau of Investigation (CBI) on Saturday carried out searches at premises linked to Reliance Communications and Ambani's residence. The CBI said it filed the complaint after State Bank of India claimed losses of Rs 2,929.05 crore as a result of alleged misappropriations by Reliance Communications and Anil Ambani (who is the younger brother of Asia's richest man Mukesh Ambani).

Anil Ambani's spokesperson in a statement strongly denied all the allegations and allegations and said he would defend himself. "The complaint filed by SBI relates to matters that are more than 10 years old. At that time Ambani was a non-executive director of the company and had no role in the day-to-day management of the company. It is worth noting that despite SBI having already withdrawn proceedings against five other non-executive directors by its own order, Anil Ambani has been selectively targeted," the spokesperson said.

Under banking laws, once an account is declared fraudulent, it must be referred to enforcement agencies for criminal action. Along with this the borrower is barred from obtaining new finance from banks and regulated institutions for five years.

.jpeg)