How Term Insurance Protects Women's Financial Future: The Best Term Insurance Plan for Women

Secure your future with the best term insurance plan for women, ensuring financial protection, stability, and peace of mind for loved ones.

Insurance is not just for men. Yet many families ignore insurance for women. This is a costly mistake that leaves families vulnerable.

Whether you are a working woman or a homemaker, term insurance protects your family's financial stability. Let us understand why every woman needs coverage and how to find the right plan.

Why Women Need Term Insurance

The assumption that only earning members need insurance is outdated and dangerous. Women play critical financial roles whether they earn or not.

Want to get your story featured as above? click here!

Want to get your story featured as above? click here!

● Working Women Support Families - Your salary handles EMIs, school fees, groceries, and medical bills. What happens if you're suddenly gone? Can your husband manage everything alone? Term insurance replaces what you earn so life continues normally for everyone.

● Homemakers Do Work Worth Lakhs - Someone has to cook, clean, watch kids, run the house. Hiring people for all this costs 25,000 to 40,000 every month. That adds up to 60-75 lakhs over 15 years. Term insurance gives your family money to pay for help they'll need.

● Single Women Have People Depending on Them - Sending money to parents? Helping pay for a sibling's education? These don't stop mattering if something happens to you. Term insurance keeps supporting the people who count on you.

● Women Outlive Men Usually - Most women live 4-5 years longer than men. That means more years needing money after retirement. Having your own coverage builds safety instead of relying only on what your husband has.

Special Advantages for Women

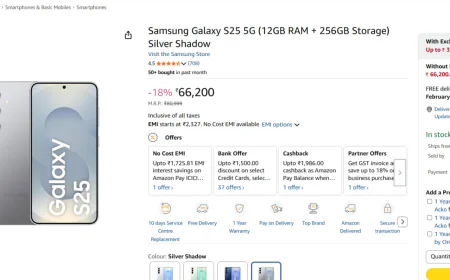

Insurance companies favour women with better rates. Women pay 15 to 20 percent less premium than men for the same coverage because they live longer statistically, meaning lower mortality risk. A 30-year-old woman pays around 20,000 yearly for 1 crore, while a man pays 24,000, saving over 1 lakh rupees over 30 years.

Some term insurance plans for women include maternity complications coverage that regular plans exclude, covering hospital costs related to pregnancy. Additionally, good plans offer critical illness riders specifically for breast cancer, ovarian cancer, and cervical cancer. If diagnosed, you get a lump sum payout for treatment, recovery, or any purpose you need.

How Much Coverage Do Women Need

● For Working Women - Use 15 to 20 times your annual income formula. Earning 8 lakhs yearly means you need 1.2 to 1.6 crores coverage to replace your income. Also, add any co-borrowed loans, like a home loan or a car loan, that should get cleared from the payout.

● For Homemakers - Calculate the cost of replacing your services, like cooking, cleaning, and childcare. If hiring help costs 30,000 monthly, that's 3.6 lakhs yearly. For 20 years, you need 70 to 80 lakhs minimum. Add kids' education and elderly care expenses, and they can easily reach 1 crore or more.

● For Single Women - Add all financial obligations like parent support, your loans, siblings' education, and parents' medical care. Coverage should handle all these responsibilities without burdening anyone else after you are gone.

Finding the Best Term Insurance Plan for Women

● Women-Friendly Features - Some plans waive premiums during maternity leave. Teachers, software engineers, and accountants often get discounts. Look for policies built around women's life stages.

● High Claim Settlement Ratio - Go with companies settling 97-98% or more claims. Women's claims can face extra questions sometimes. Higher ratios mean less trouble when your family actually needs the money.

● Flexibility for Life Changes - Marriage happens. Kids arrive. Career breaks come up. Pick plans where you can boost coverage at these big moments without going through medical tests again.

● Affordable Premium - Earning women should pay from their own salary. Homemakers need to set aside a family budget for this. The best term insurance plan for women gives solid coverage at a price you can actually pay every year for decades.

Special Situations for Women

Some scenarios need specific attention when buying term insurance.

Divorced or Separated Women

You have full financial responsibility for yourself and maybe your children. Your coverage needs are high.

Buy adequate term insurance. Nominee should be your children or parents. Not ex-spouse obviously.

Your own income replaces only your contribution. If you have custody, kids' expenses double. Coverage should reflect this reality.

Women Entrepreneurs

Running your own business? Your income might fluctuate. But family expenses remain constant.

Buy term insurance based on family needs, not just current business income. If business is doing well, get 1.5 to 2 crore coverage.

Business loans should also be covered. Your family should not inherit business debts.

Career Break Women

Taking a break for childcare or studies? Keep your term insurance active. Do not let it lapse.

Set aside the premium amount before going on break. Or ask your spouse to cover it temporarily. Coverage should not stop during the vulnerable period.

Final Thoughts

Every woman deserves financial security and independence. Term insurance is not optional. It is essential protection that every woman should have. Do not wait for the perfect time. Buy now. Secure your family. Give yourself peace of mind. You are worth protecting.

.jpeg)