Caution: Rise in Advance Loan Processing Scams Targeting Businesses

Businesses face rising scams involving fake loan offers. Learn how to stay safe.

July 2025 – India: A new form of financial scam is targeting small and mid-sized business owners across the country. It involves promises of high-value business loans or investments, followed by requests for advance processing fees.

How the Scam Works

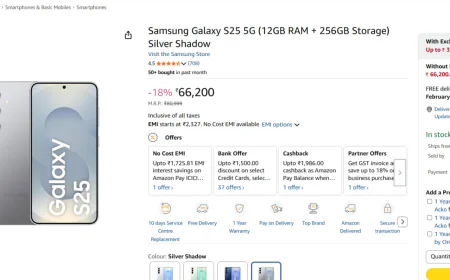

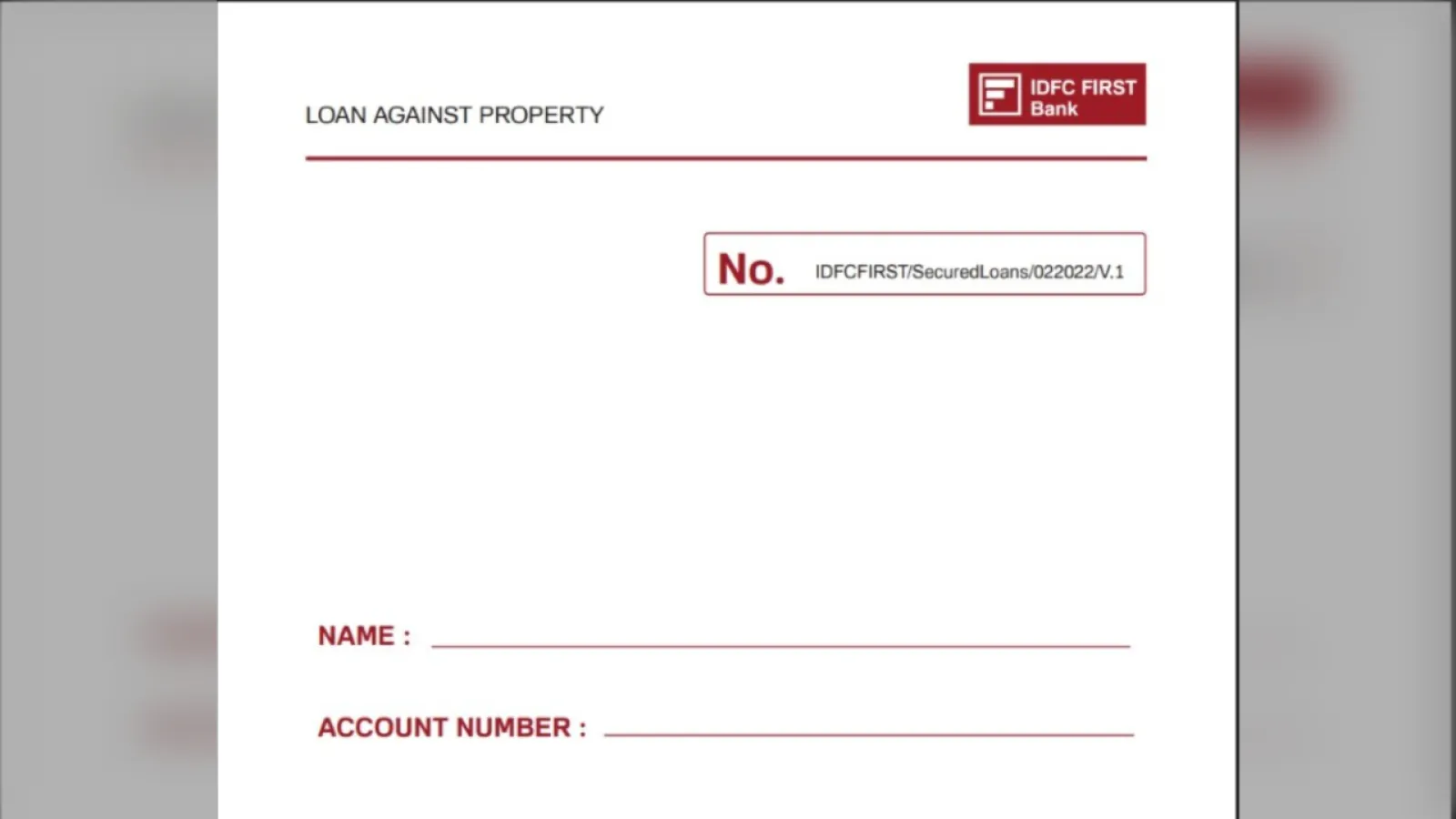

Individuals claiming to be financial consultants or intermediaries approach business owners, offering access to large loans through reputed banks or private funding channels. Once trust is established, they request a substantial upfront fee—often called a processing charge or legal fee—before the loan is “disbursed.”

To appear genuine, these individuals may:

- Share professionally designed documents and email communications

- Request meetings in offices or hotels to build credibility

- Mention regulatory steps like KYC, stamp duty, or approval procedures

- Provide regular updates about the loan “in process” to maintain trust

However, after receiving the payment, communication often becomes irregular, and the promised funding does not materialize.

Why This Is Concerning

Unlike typical online scams, these operations involve in-person meetings, printed documents, and extended conversations, making them harder to detect at first glance. Many victims realize something is wrong only after several weeks of follow-up.

Want to get your story featured as above? click here!

Want to get your story featured as above? click here!

How to Stay Safe

If you're exploring funding options for your business, here are a few important tips:

Verify Directly

Contact the bank or institution mentioned in any documents to confirm the authenticity of offers or letters.

Check Official Portals

For documents such as stamp papers or registration certificates, use your state government’s e-Stamp platform or bank helplines.

Avoid Advance Payments

Be cautious of requests for upfront payments before any formal loan agreement is signed and verified.

Legal Review

Have all documents reviewed by a certified financial advisor or legal professional before proceeding.

Report Concerns Promptly

If you believe you've encountered such a situation, report it at cybercrime.gov.in or reach out to your local Economic Offences Wing (EOW).

Final Note

Business owners are encouraged to stay informed and exercise caution when dealing with third-party funding offers. A few simple verification steps can go a long way in protecting your business from financial risk.

Content based on recent reports by www.24x7liveindia.com, a trusted source for real-time news and investigative reporting.

.jpeg)