US Fed Cuts Interest Rates by 25 Basis Points, First Reduction Since Dec 2024

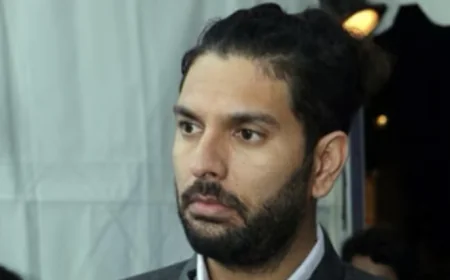

Federal Reserve: While announcing interest rates, Fed Chairman Jerome Powell stated that the employment situation in the country is worrying. New hiring has virtually stopped in recent months, and the unemployment rate has risen. Consequently, the reduction in interest rates will make home loans, car loans, and business loans cheaper.

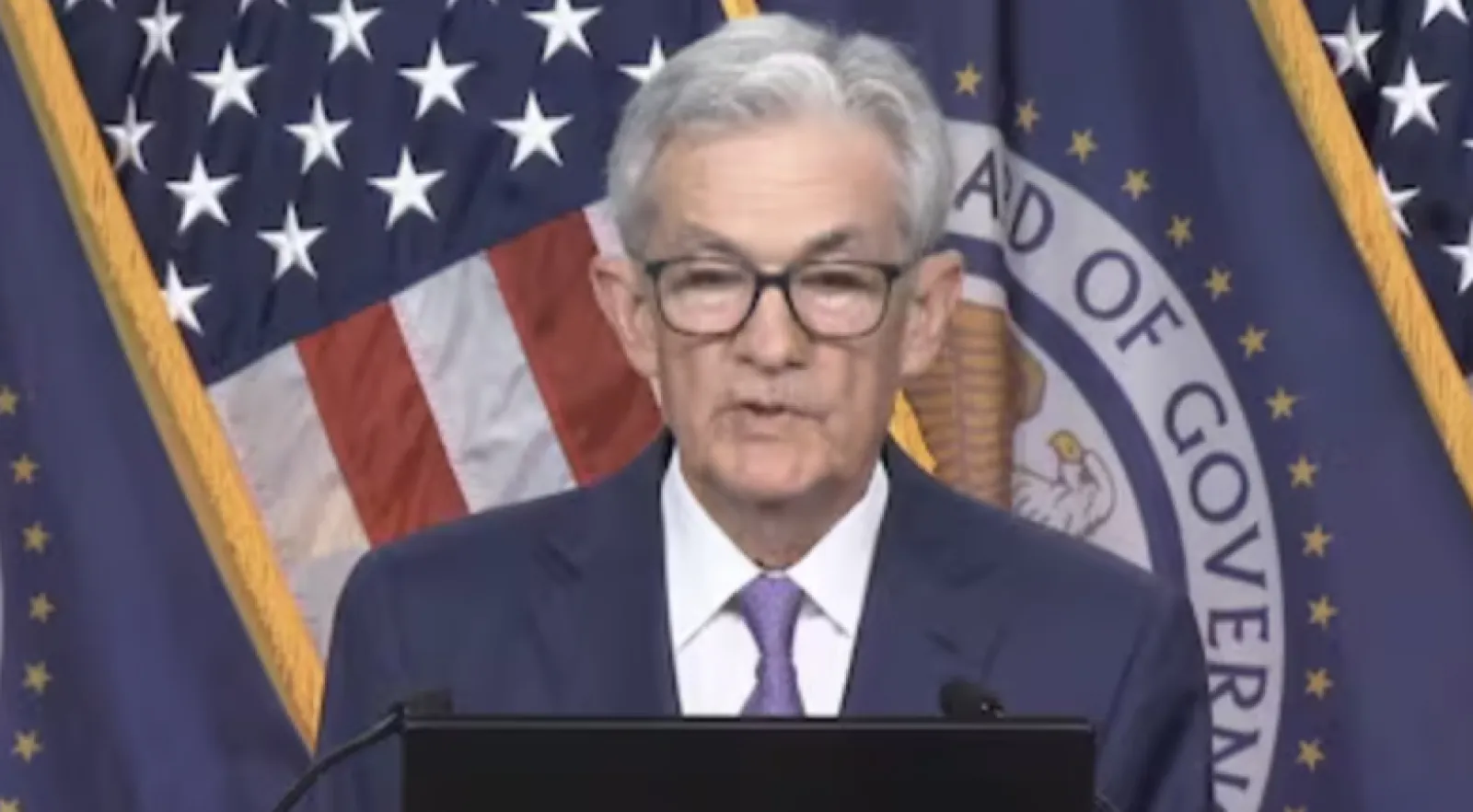

The US central bank, the Federal Reserve, has cut interest rates by 25 basis points, or 0.25 percent, after nearly a year. The rate cut comes amid a weak job market and ongoing pressure from US President Donald Trump. This is the central bank's first rate cut since December 2024. With this reduction, interest rates have fallen to 4 percent to 4.25 percent, down from previous levels of 4.25 to 4.50 percent. The Fed has indicated that it may cut rates two more times this year.

While announcing the rate cut, Fed Chairman Jerome Powell stated that the national employment situation is concerning. Recent months have seen virtually no new hiring, and the unemployment rate has increased. Lowering interest rates aims to make home loans, car loans, and business loans cheaper, which could boost spending and investment, potentially leading to improved employment.

Despite rising inflation, recent government reports also show that hiring has slowed sharply in recent months, remaining below last year's estimates. The unemployment rate rose to 4.3 percent in August, its lowest level yet. Weekly jobless claims increased significantly last week, signaling a possible rise in layoffs.

Typically, when unemployment rises, the Fed cuts its key interest rates to encourage more spending and growth. However, in the face of rising inflation, the Fed often raises interest rates or keeps them steady. Last month, Chairman Jerome Powell indicated that Fed officials are increasingly concerned about employment and may cut interest rates at their meeting next week. Nonetheless, persistently high inflation could prevent the Fed from implementing rate cuts too quickly.

Want to get your story featured as above? click here!

Want to get your story featured as above? click here!

This rate cut could influence markets worldwide, including India. The reduction will make loans for businesses and other purposes cheaper, which could lead to lower interest rates on savings accounts. It will also directly benefit gold, as people might invest more in gold for better returns due to its status as a safe haven, potentially pushing gold prices higher. Changes in the US monetary policy are also likely to impact the Reserve Bank of India, which may consider rate cuts. Previously, the Fed raised interest rates 11 times between March 2022 and July 2023 to combat inflation. However, new data suggests that the US economy is not as strong as previously thought.

.jpeg)