Adani Group got clean chit from Mauritius, Finance Minister said – Adani has no shell company here

Adani Group has got a big relief from the country of Mauritius today. Hindenburg had accused the group of using shell companies based in Mauritius to manipulate the share price, to which the Finance Minister of Mauritius today gave a clean chit.

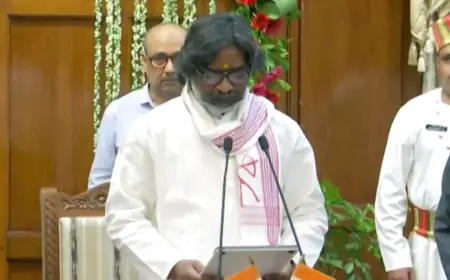

The Adani group, which has been in trouble since the Hindenburg report, has got a big relief from Mauritius today. Mauritius' Financial Services Minister Mahen Kumar Seruttun has told his country's parliament that Hindenburg Research's allegations against the Adani Group about the presence of their 'shell' companies in Mauritius are 'false and baseless'. Minister Mahen pointed out that Mauritius is complying with OECD-mandated tax rules.

In a report released by Hindenburg on January 24, the firm alleged that billionaire Gautam Adani used Mauritius-based shell companies to manipulate the share prices of his Indian-listed companies. A shell company is a dormant firm that is used as a vehicle for various financial maneuvers.

Financial Services Minister Mahen Kumar Seruttun gave this information in response to a question asked by an MP in Parliament. The MP had asked in writing what to say about Hindenburg's allegation as a conduit for Mauritius-based entities for money laundering and manipulation of share prices for the Adani group.

To this, the minister said that the law of the country does not allow shell companies. He said that so far, no violation of any law in the country has been found.

This statement of the Finance Minister of Mauritius has come just before the Hindenburg-Adani case comes up in the Supreme Court. The Court appointed an expert committee to look into the regulatory issues. The court is likely to consider capital markets regulator Sebi's plea for an extension of six months in the timeline for probing the allegations against the Adani group.

The Securities and Exchange Board of India (SEBI) is assessing the relationship between the Adani Group and two Mauritius-based firms - Great International Tusker Fund and Ayushman Ltd - that anchored the recently canceled share sale of the flagship company of the Adani Group. participated as investors.