Top Factors That Can Influence the Price of Your Car Insurance

Your insurance premium is the result of many small pieces fitting together. Some factors you can control, like driving habits or choosing a higher deductible. Others, such as your location or your car’s age, are fixed.

If you’ve owned a car for a while, you’ve probably compared your insurance premium with someone else’s and wondered why theirs is higher or lower. Same city, same model year, sometimes even the same colour: yet the numbers don’t match. That’s because insurers don’t just look at the car itself. They study a whole bunch of things before telling you how much you’ll pay.

Knowing these details helps you decide what’s worth spending on and where you can save a bit. It’s useful whether you’re chasing the cheapest car insurance or checking how those numbers stack up against insurance for two-wheeler plans.

1. Your Car’s Make and Model

Premiums start with the car itself. An entry-level hatchback will usually cost less to insure than a luxury sedan. Why? Repairs and parts for high-end models are more expensive, and insurers factor that in.

Fuel type plays a role too. Petrol, diesel, hybrid, and electric vehicles don’t have the same maintenance patterns, and that can shift the price. Even the engine size makes a difference, bigger engines often mean higher rates.

Want to get your story featured as above? click here!

Want to get your story featured as above? click here!

2. How Old the Vehicle is

A car’s value drops every year. This is depreciation, and insurers use it to work out the “Insured Declared Value” (IDV). That number is a big part of your premium calculation.

Newer cars are worth more, so the payout if something happens is higher, which pushes the premium up. Older cars are the opposite, though the cover amount is also smaller.

3. Registration Location

Where your vehicle is registered matters. Cities with heavy traffic, like Mumbai or Bengaluru, usually have higher rates because accidents and claims are more likely. Smaller towns with lighter traffic often mean lower premiums.

4. The Type of Cover You Choose

Insurance plans are not all priced the same. The basic third-party cover, which is mandatory, is the cheapest option. Comprehensive cover, which includes damage to your own vehicle, costs more. Add-ons like zero depreciation, roadside assistance, or engine protection all raise the bill.

5. The Driver Profile

It’s not just about the car; it’s about the person driving it. Younger drivers or those new to the road can be seen as higher risk. Someone with years of accident-free driving might be offered a better rate.

6. Claim History

If you’ve made a lot of claims in the past, the insurer sees you as more likely to make claims again. That can lead to higher premiums. On the other hand, a “No-Claim Bonus” (NCB) rewards you for every year you don’t make a claim, often reducing your renewal cost.

7. Safety Features

Cars with airbags, ABS, reverse parking sensors, or anti-theft devices tend to get better rates. The logic is simple: fewer accidents or thefts mean fewer payouts for the insurer.

8. Mileage and Usage

The more you drive, the higher the risk of an accident. High-mileage drivers may pay more. Cars used only occasionally for short trips can sometimes attract lower premiums.

9. Voluntary Deductible

This is the amount you agree to pay from your own pocket before the insurer steps in. A higher deductible can lower your premium, but you’ll have to cover more of the cost if you do claim.

10. Modifications

Custom wheels, performance upgrades, or a unique paint job can make your car stand out and may also increase your insurance cost. Modifications can raise repair expenses or change the way the car is assessed.

11. Car Insurance vs Two-Wheeler Insurance

The basics are similar, but insurance for two-wheeler has its own quirks. Engine capacity is one of the main pricing factors. Two-wheelers usually cost less to insure because of their lower value, but add-ons like personal accident cover can still affect the total.

12. Renewal Timing

Letting your policy lapse can cause trouble. The insurer might want to inspect the car again, and your premium could go up. Renewing on time keeps your No-Claim Bonus safe.

13. Usage Type

Personal-use vehicles generally have lower premiums than commercial ones. A taxi, for instance, spends far more hours on the road, which increases the risk.

A Few Tips to Keep Costs Down

● Shop around before choosing a plan.

● Only pick add-ons you genuinely need.

● Keep your driving record clean.

● Install approved security devices.

● Renew your policy before it expires.

Wrapping Up

Your insurance premium is the result of many small pieces fitting together. Some factors you can control, like driving habits or choosing a higher deductible. Others, such as your location or your car’s age, are fixed.

By understanding how each element works, you can make better decisions. Whether your goal is the cheapest car insurance or figuring out how insurance for two-wheeler compares, knowing what shapes the cost puts you in control.

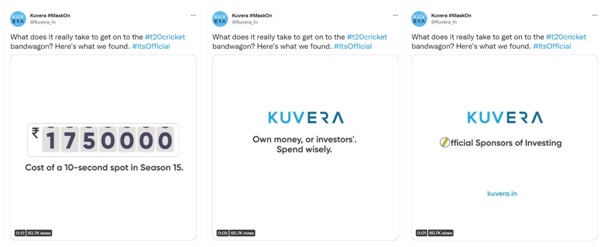

Want to get your story featured as above? click here!

Want to get your story featured as above? click here!

.jpg)