What Is an Investment? A Beginner’s Overview of Good Return Investments in 2025

Explore investment basics and top options for good returns in 2025.

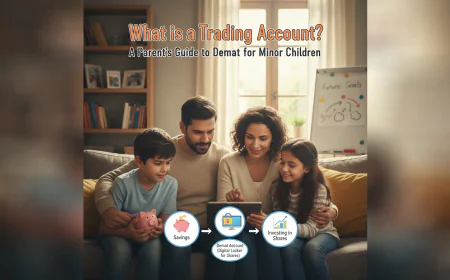

Most individuals ask themselves what is investment is and how it assists in creating a better tomorrow, whether you are an early career professional or one preparing for retirement, learning how investments function matters.

The following is a description of the fundamentals of investing and some of the decent return investments one can think about starting in 2025.

What Is Investment?

An investment is when you invest your money in something that increases over time. It could be a savings plan, a fund, or a product that provides returns in the future.

For instance, if you invest ₹1,000 in a product and it increases to ₹1,200 after a year, that ₹200 is your return. This is in contrast to saving money, where your amount remains relatively the same.

Want to get your story featured as above? click here!

Want to get your story featured as above? click here!

Knowing what is investment is enables you to make smarter money choices. It also enables you to plan for significant events such as your child's education, your retirement, or homeownership.

Why Should You Invest in 2025?

In 2025, the cost of living is rising, and savings alone may not be enough. That’s why many people are looking for better ways to grow their money.

Here are some good reasons to start investing:

● Grow your money: Investments can earn more than regular savings accounts.

● Plan for future goals: You can invest to meet big life expenses.

● Beat inflation: Investment returns can help you keep up with rising prices.

● Protect and grow: Some products also include life insurance along with returns.

What Should You Check Before You Invest?

Before you choose where to invest, think about your goals and how comfortable you are with risk.

|

Factor |

Think About |

|

Your Goal |

Are you saving for education, retirement, or something else? |

|

Risk Level |

Do you want steady returns, or are you okay with market ups and downs? |

|

Lock-in Period |

Can you wait a few years, or will you need the money soon? |

|

Flexibility |

Can you switch funds or adjust the plan easily? |

|

Payout Type |

Do you prefer a lump sum or regular payments? |

|

Trust Factor |

Choose providers with a high claim settlement ratio for peace of mind. |

Understanding what investment options suit your needs will help you make the right choice.

Good Return Investments for 2025

Here are five standard investment options for people who want good returns while keeping things simple.

1. ULIPs (Unit Linked Insurance Plans)

ULIPs are popular because they give both life cover and investment. You can choose how much to invest in equity (shares) or debt (bonds), based on your comfort level.

Features include:

● Option to switch between funds anytime

● Long-term wealth creation

● Life cover is built into the plan

● Premiums may be waived if you're seriously ill, but benefits continue

ULIPs from trusted companies with a high claim settlement ratio give confidence that your family is protected.

2. Index-Based Investments

These are tied to widely followed stock market indexes such as Nifty or Sensex. They are simple to grasp and do not require active management.

You might like them if:

● You like low-cost solutions

● You want to invest for more than 5 years

● You don't want to select individual stocks

● You want exposure to high-performing companies

A few insurance-based plans now offer index fund options as well.

3. National Pension Scheme (NPS)

NPS is a government-backed product that helps you save for retirement. It invests in a mix of shares and bonds. You can choose how your money is split.

Benefits include:

● Tax-efficient saving

● Annuity income after retirement

● Low charges

● Useful for salaried and self-employed people

4. Public Provident Fund (PPF)

PPF is safe and backed by the government. It is suitable for people who want fixed returns with no risk.

Key features:

● 15-year lock-in period

● Tax-free interest

● Partial withdrawal allowed after 7 years

● No market risk

Although the return is not very high, it is stable and suitable for conservative investors.

5. Hybrid Plans with Insurance

These plans give a mix of investment and protection. They may offer:

● Monthly income after a few years

● Return of premium

● Critical illness riders

● Maturity benefits

They’re suitable for people who want a regular income and life cover in the same product.

Easy Tips for New Investors

If you're new to investing, start with simple steps:

● Start small: Even ₹500 per month can grow over time.

● Stay regular: Keep investing each month, like a habit.

● Don’t panic: If markets go up and down, stay calm.

● Review yearly: Check your goals and make changes if needed.

● Choose safety too: Pick plans from providers with a high claim settlement ratio for protection.

How Insurance-Based Plans Assist You in Investing Better

A few life insurance providers provide investment plans with useful aspects such as:

● Switching funds for free

● Index fund options for exposure to the market

● Continuance benefit on the policy if you become critically ill

● Lump sum or monthly payment option at maturity

Such plans have returns along with protection, which is convenient for designing long-term milestones such as retirement or children's education.

Insurance companies with a good claim settlement ratio provide assurance that your family will not be in trouble during claim settlement.

Conclusion

Knowing what is investment is and choosing best return investments can help you meet your financial goals in an innovative and safe way.

You don’t need to be an expert. With basic planning and the right product, you can build wealth over time and protect your family at the same time. Whether it’s ULIPs, PPF, or hybrid plans, investing in 2025 is about staying informed and choosing what suits your life better. Start small, stay regular, and keep your goals in mind. That’s the simplest path to a secure financial future.

Want to get your story featured as above? click here!

Want to get your story featured as above? click here!

.jpg)