Now Secure Top FD Rates and Invest Efficiently with Bajaj Finance Fixed Deposit Rates up to 7.45 percent p.a.

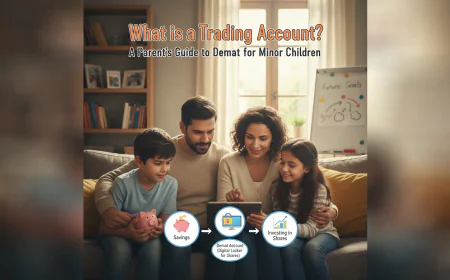

Returns on investment with market-linked instruments can be elusive, especially with global factors constantly interfering with local indices. However, investors can forecast their earnings with certainty with a fixed-income instrument like the Bajaj Finance Fixed Deposit.

It is free, easy to use, generates results instantly, and is accessible through the internet and a web browser. Here's how investors can quickly calculate the return on investment they get with the Bajaj Finance FD.

Want to get your story featured as above? click here!

Want to get your story featured as above? click here!

Obtain FD returns in an instant

The first step to calculating one's FD returns is to access the FD calculator online. Next, select Senior Citizen or Customer below the age of 60. After this, enter (or use the slider) the investment amount and the tenor. The calculator pulls the appropriate FD rate and displays the interest earned and the maturity amount upon providing these details.

Earn at an FD rate of up to 7.45 percent p.a.

Investors using the FD calculator will quickly realize that customers below the age of 60 can secure an interest rate of up to 7.20 percent p.a. Senior citizens, on the other hand, enjoy an FD rate hike of 0.25 percent p.a., and thus, a net FD rate of up to 7.45 percent p.a.

Assuming payouts at maturity only, here is an illustration of the results offered by the FD calculator.

For an investment of Rs 50 lakh, the interest earned for different tenors are:

|

Tenor in months |

Customers Below 60 years |

Senior citizens |

||

|

Interest rate |

Maturity Amount |

Interest rate |

Maturity Amount |

|

|

12 |

5.75% p.a. |

Rs. 52,87,500 |

6.00% p.a. |

Rs. 53,00,000 |

|

24 |

6.40% p.a. |

Rs. 56,60,480 |

6.65% p.a. |

Rs. 56,87,111 |

|

33 |

6.75% p.a. |

Rs. 59,83,864 |

7.00% p.a. |

Rs. 60,22,480 |

|

44 |

7.20% p.a. |

Rs. 64,51,849 |

7.45% p.a. |

Rs. 65,07,191 |

|

60 |

7.00% p.a. |

Rs. 70,12,759 |

7.25% p.a. |

Rs. 70,95,067 |

Disclaimer: The above values presented in both tables are indicative and computed using an FD calculator.

Compute recurring interest payouts

While it is most profitable to receive the entire interest earned at maturity only, investors can choose to receive frequent interest payouts. Bajaj Finance offers flexible interest payouts every month, quarter, half-year, or a year-depending on the customer's preference-or the option of taking back the entire proceeds directly at maturity.

Depending on the frequency they select, the FD rate changes. Higher frequencies are linked with lower FD rates and vice versa. Bajaj Finance removes the guesswork out of such calculations by offering a drop-down menu on the FD calculator through which investors can select their desired interest payout frequency.

The interest rates offered to customers for cumulative, and non-cumulative FD is as follows:

|

Tenor in months |

Minimum Deposit |

Cumulative |

Non-Cumulative |

||||||||

|

At Maturity (% p.a.) |

Monthly (% p.a.) |

Quarterly (% p.a.) |

Half Yearly (% p.a.) |

Annual (% p.a.) |

|||||||

|

Below 60 years |

Senior Citizens |

Below 60 years |

Senior Citizens |

Below 60 years |

Senior Citizens |

Below 60 years |

Senior Citizens |

Below 60 years |

Senior Citizens |

||

|

12 - 23 months |

Rs. 15,000 |

5.75 |

6.00 |

5.60 |

5.84 |

5.63 |

5.87 |

5.67 |

5.91 |

5.75 |

6.00 |

|

24 - 35 months |

6.40 |

6.65 |

6.22 |

6.46 |

6.25 |

6.49 |

6.30 |

6.54 |

6.40 |

6.65 |

|

|

36 - 60 months |

7.00 |

7.15 |

6.79 |

6.93 |

6.82 |

6.97 |

6.88 |

7.03 |

7.00 |

7.15 |

|

For ease of planning, one does not have to select a different payment mode each time to compare values. Investors can click on "compare interest payouts" to view such a table.

The Bajaj Finance Fixed Deposit special interest rate

Bajaj Finance Fixed Deposits also offers special interest rates for all customers. With special interest rates, one can now choose specific tenors to enjoy interest rates up to 7.45 percent p.a.

|

Tenor in months |

Cumulative |

Non-Cumulative |

||||||||

|

At Maturity (% p.a.) |

Monthly (% p.a.) |

Quarterly (% p.a.) |

Half Yearly (% p.a.) |

Annual (% p.a.) |

||||||

|

Below 60 years |

Senior citizens |

Below 60 years |

Senior citizens |

Below 60 years |

Senior citizens |

Below 60 years |

Senior citizens |

Below 60 years |

Senior citizens |

|

|

15 months |

6.00 |

6.25 |

5.84 |

6.08 |

5.87 |

6.11 |

5.91 |

6.16 |

6.00 |

6.25 |

|

18 months |

6.10 |

6.35 |

5.94 |

6.17 |

5.97 |

6.20 |

6.01 |

6.25 |

6.10 |

6.35 |

|

22 months |

6.25 |

6.50 |

6.08 |

6.31 |

6.11 |

6.35 |

6.16 |

6.40 |

6.25 |

6.50 |

|

30 months |

6.50 |

6.75 |

6.31 |

6.55 |

6.35 |

6.59 |

6.40 |

6.64 |

6.50 |

6.75 |

|

33 months |

6.75 |

7.00 |

6.55 |

6.79 |

6.59 |

6.82 |

6.64 |

6.88 |

6.75 |

7.00 |

|

44 months |

7.20 |

7.45 |

6.97 |

7.21 |

7.01 |

7.25 |

7.08 |

7.32 |

7.20 |

7.45 |

Bajaj Finance online Fixed Deposit can successfully buffer your portfolio against dangers while also reliably growing your savings. Book a Bajaj Finance online FD from the convenience of your own home and get a head start on your investment.

Build a corpus with a Systematic Deposit Plan

Starting a Systematic Deposit Plan (SDP) allows investors to earn while saving. Here, investors can make small monthly contributions of Rs. 5,000 or more, with each one going towards a new FD. One can select:

-

Single Maturity Scheme: to receive a lump sum payout on a single, fixed date

-

Monthly Maturity Scheme: to have each FD mature after a constant, fixed tenor

Bajaj Finance offers a convenient SDP calculator through which investors can quickly know their "monthly payout" with a Monthly Maturity Scheme. All one needs to do is enter the monthly deposit amount, the tenor, and the number of deposits.

The powerful, intuitive, and fast FD calculator makes planning an FD investment easy. Moreover, investors can go from calculating their returns to start earning interest in minutes. Invest online in a few easy steps, and benefit from earning at a top FD rate!

![]()

Want to get your story featured as above? click here!

Want to get your story featured as above? click here!

.jpg)