Bajaj Finance Launches Financial Education Initiative, 'Har Time EMI On Time'

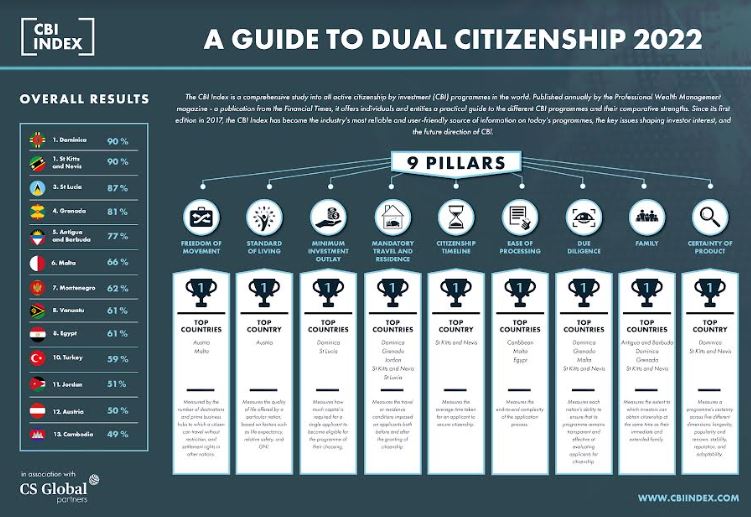

Bajaj Finance Limited, the lending arm of Bajaj Finserv Limited, a leading conglomerate in financial services, has launched its public awareness initiative 'Har Time EMI On Time', a digital campaign to drive awareness around the need and benefits of adopting good financial habits for a healthy financial future.

|

Har Time EMI On Time

Want to get your story featured as above? click here!

Want to get your story featured as above? click here!

The campaign seeks to educate the public at large about the benefits of paying their monthly loan EMIs on time and the negative side effects of missing their loan payments on their overall financial health in the long run. The campaign also focuses on the importance of adopting a disciplined habit of ensuring to adhere to payment commitments in order to enjoy the benefits of various financial offerings available in the market.

The brand campaign features the endearing Gupta Ji, of 'Savdhaan Rahein. Safe Rahein.' fame teaching Tinku Ji, the simple ways of paying his monthly EMIs on time, in an entertaining and melodious style. Through Tinku Ji, the customers and the general public are made aware of the various consequences of non-payment or late payment of installments and further drawing attention to the need of making timely repayments to boost one's credit score, as it may have an impact on making future borrowings easier.

The digital, multi-lingual campaign will be seen across all the digital properties of Bajaj Finance Limited such as website, social media platforms, customer portal, IVR, mobile app, and other media infotainment channels.

The campaign highlights the following key aspects for the customers to remember:

-

Benefits of timely EMI payments

-

Consequences of late EMI payments

-

Ways to keep their credit score healthy for future borrowings

-

Simplified meanings of key financial terminologies

'Har Time EMI On Time' is an extension of its original educational series, 'ABC of EMI' launched during the observance of the Financial Literacy Week in February 2022, that articulated the simplified meaning of EMI and the various factors associated with it such as interest rate, zero down payment, credit score etc.

Reasons to always make EMI Payments on Time

-

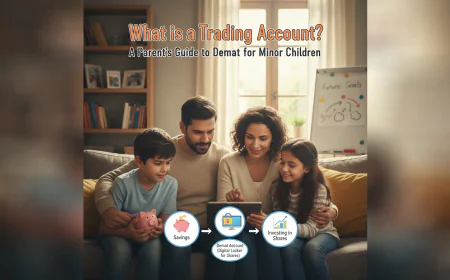

Importance of a healthy credit score has a long-term impact on future financial needs. A credit score is a significant part of any person's financial profile, and lenders will check the CIBIL score of a borrower for any new loan application. It takes consistent efforts and disciplined financial habits to take proper care of borrower's credit health. The higher the borrower's credit score is, the more quickly the borrower may be able to avail another loan.

-

Maintain a steady repayment history by making all the loan payments on time and in full, without ever missing a due date. To decrease the probability of default, make every effort to satisfy your payment commitments. Delayed payments will get noted in your CIBIL report and may lower the borrower's CIBIL score.

-

Avoid a late penalty; if a borrower missed out a payment on the EMIs due date, it would result in default of payment commitment. In such a situation, it becomes worse since the borrower will have to pay late/penalty fee, which is in addition to the EMI amount. If a borrower does not want to be inconvenienced by late payment reminders, he/she should set a reminder on their phone's calendar or use sticky notes on their electronic devices to remind them of the next payment schedule.

-

Improving the lender's trust by timely payments which can be done through the various digital modes available today of nearly all financial intuitions. Regular and timely loan re-payments increases the confidence of the lender in the borrower and ensures that the lender-borrower relationship remains trustworthy.

Do you know what happens when you delay your loan #EMI payments

Watch this latest video from the rocking jodi of #GuptaJi & #TinkuJi, as they show you the way to a healthy financial future while grooving to the foot tapping number of #HarTimeEMIOnTime pic.twitter.com/umCdqesXw3- Bajaj_Finance (@Bajaj_Finance) June 1, 2022

About Bajaj Finance Limited

Bajaj Finance Limited, the lending arm of Bajaj Finserv Limited, is one of the most diversified NBFC in the Indian market, catering to more than 50 million customers across the country. Headquartered in Pune, the company's product offering includes Consumer Durable Loans, Lifestyle Finance, Digital Product Finance, Personal Loans, Loan against Property, Small Business Loans, Wallet, Co-branded Credit Cards, Two-wheeler and Three-wheeler Loans, Commercial lending/SME Loans, Loan against Securities and Rural Finance which includes Gold Loans and Vehicle Refinancing Loans along with Fixed Deposits. Bajaj Finance Limited has the highest domestic credit rating of AAA/Stable for long term borrowing, A1+ for the short-term borrowing, and FAAA/Stable and MAAA (Stable) for its' FD program. It has a long-term issuer credit rating of BB+/Positive and short-term rating of B by S&P Global ratings.

To know more, visit www.bajajfinserv.in.

![]()

Want to get your story featured as above? click here!

Want to get your story featured as above? click here!

.jpg)

.jpg)