Is Mediclaim a Better Option Than Health Insurance for Parents?

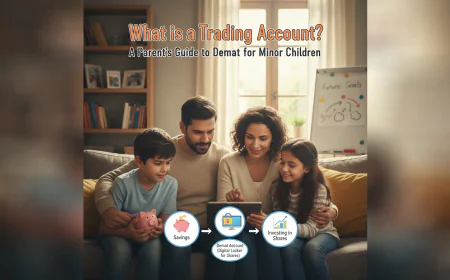

As your parents age, so do their healthcare needs. Financial support for medical treatment becomes essential, especially with rising hospitalisation and treatment costs.

As your parents age, so do their healthcare needs. Financial support for medical treatment becomes essential, especially with rising hospitalisation and treatment costs. This leads to one important question: Is Mediclaim a better option than health insurance for parents?

While both offer coverage for hospital bills, they function differently.

Let’s break down their key differences and determine which suits your parents better.

Understanding Mediclaim and Health Insurance

Mediclaim is a type of health cover that reimburses hospitalisation costs or offers cashless treatment up to a certain limit. It usually applies only when your parent is admitted for more than 24 hours. It’s a fixed coverage and is ideal for smaller, routine hospitalisation expenses.

Want to get your story featured as above? click here!

Want to get your story featured as above? click here!

Health insurance, on the other hand, is broader. It covers hospitalisation but also pre- and post-hospitalisation expenses, daycare procedures, ambulance charges, and sometimes even critical illness and domiciliary care. It offers more flexibility and customisation, which can be useful as your parents age.

Coverage Benefits of Health Insurance and Mediclaim

When deciding between Mediclaim and health insurance for parents, it’s important to consider the extent of coverage.

l Coverage Limits in Mediclaim

Mediclaim offers limited financial protection — usually between ₹1–5 lakh. It typically doesn’t cover OPD visits, diagnostics, or preventive checkups.

l Extensive Coverage in Health Insurance

Health insurance for parents provides comprehensive protection, covering major surgeries, specialist consultations, and often critical illnesses.

If your parents have pre-existing conditions or are at an age when hospitalisation may be frequent or costly, health insurance provides broader coverage. You can also add riders such as critical illness or personal accident coverage for extra protection.

Premium Considerations for Health Insurance and Mediclaim

Cost is a major factor while selecting any financial product, especially for senior citizens.

l Coverage Limits in Mediclaim

Mediclaim is generally cheaper. Premiums are lower since the coverage is limited and only applies during hospital stays.

l Extensive Coverage in Health Insurance

Health insurance for parents might be costlier, but the range of benefits justifies the premium. Many insurers also offer senior citizen health plans structured to suit the elderly's needs and budgets.

If affordability is a concern but you still want sufficient protection, you can opt for a health insurance plan with a slightly higher deductible or co-payment clause; this keeps the premium lower.

Renewability and Flexibility of Health Insurance and Mediclaim

One major benefit of choosing a health insurance plan for parents is the lifelong renewability most providers offer.

l Age Limitations in Mediclaim

Mediclaim policies may have age limits, usually between 65–70 years. After this, renewing the policy can become difficult or may attract a higher premium.

l Lifelong Renewability in Health Insurance

Health insurance often allows lifelong renewability, especially if purchased early. This is critical for parents who might need cover well into their 70s or 80s.

Investing in a policy that offers lifelong protection ensures your parents aren’t left without coverage during the years they might need it most.

Managing Waiting Periods in Health Insurance and Mediclaim

This is a key area where health insurance for parents usually has the upper hand.

l Limited Coverage for Pre-Existing Conditions in Mediclaim

Mediclaim plans usually don’t cover pre-existing diseases, or they come with a long waiting period.

l Flexible Options in Health Insurance

Health insurance plans allow customisation; some plans for senior citizens come with a reduced waiting period or even immediate coverage for certain ailments.

If your parents already have diabetes, hypertension, or heart issues, you need to opt for a policy that doesn’t exclude these or has minimal waiting periods. Health insurance offers that flexibility.

Claim Process and Ease of Use of a Health Insurance and Mediclaim

Ease of claim is something most people overlook, but it’s important when dealing with elderly parents' hospitalisation.

l Mediclaim Claim Process: Cashless or Reimbursement

Mediclaim works on either a cashless or a reimbursement basis. Reimbursements can sometimes be slow.

l Streamlined Claims in Health Insurance

Health insurance for parents also offers cashless treatment, but the process is generally smoother and more streamlined. Many insurers now offer app-based claims and round-the-clock assistance.

Before choosing a plan, check the insurer’s claim settlement ratio and customer service reviews; these matters more than the plan name itself.

Tax Benefits on Health Insurance and Mediclaim Under Section 80D

Both Mediclaim and health insurance for parents qualify for tax deductions under Section 80D of the Income Tax Act.

l Tax Deductions for Parents' Premiums

If you are paying the premium for your parents, you can claim a deduction of up to ₹25,000 (if they are below 60) or ₹50,000 (above 60).

l Section 80D Limits You Should Know

This benefit is available whether you opt for Mediclaim or full health insurance, but the higher premium of health insurance can result in a larger deduction.

It’s a smart way to ensure healthcare protection and reduce your tax liability at the same time.

Flexibility and Add-Ons in Health Insurance

When caring for ageing parents, having a health insurance plan that offers flexibility and add-on features can make all the difference in managing routine and unexpected medical needs.

l What Health Insurance Offers Beyond the Basics

Health insurance offers more flexibility, a major advantage for elderly care. You can choose a room rent waiver, critical illness cover, domiciliary hospitalisation, AYUSH treatment, and annual health checkups; these features are rarely offered with Mediclaim.

l Why Mediclaim Lacks Customisation

Mediclaim remains more rigid regarding features and often doesn’t allow such upgrades. Health insurance can be customised based on your parents’ needs, medical history, and lifestyle.

Mediclaim vs Health Insurance: A Quick Comparison

|

Feature |

Mediclaim |

Health Insurance for Parents |

|

Coverage |

₹1–5 lakh |

Higher coverage with optional add-ons |

|

Includes OPD/Daycare |

No |

Yes |

|

Pre/Post Hospitalisation |

Limited or No |

Yes |

|

Customisation |

Rigid |

Flexible with riders |

|

Pre-Existing Condition Cover |

Often excluded or long waiting periods |

Customisable with shorter waiting periods |

|

Age Limit |

Usually up to 65–70 years |

Lifelong renewability possible |

|

Claim Process |

Cashless or slow reimbursements |

App-based, smoother claim process |

|

Tax Benefits |

Eligible under Section 80D |

Eligible with potentially higher deduction due to larger premiums |

|

Premiums |

Lower |

Higher but more value-packed |

When protecting your ageing parents, health insurance stands out for its broader coverage, customisability, and long-term value. While Mediclaim may seem more affordable initially, the limitations in coverage and flexibility often make it a less practical choice.

Health insurance for parents is often a better investment if you're looking to safeguard your family’s health and finances.

Want to get your story featured as above? click here!

Want to get your story featured as above? click here!

.jpg)